Learning from Ben M. “Bud” Brigham

No one embodies the full-circle success of the Permian Basin, nor the spirit of the American wildcatter, more than Ben M. “Bud” Brigham. From humble beginnings exploring conventional targets in the Permian Basin with 3-D seismic and $25,000 in initial investment capital, Brigham subsequently built world-class positions in unconventional plays–first in the Williston, and then the Permian–and closed separate billion-dollar transactions in both basins.

After reaching the pinnacle of success playing the role of the independent oilman, Brigham is now recasting himself as the “independent sandman,” helping the companies that not long ago were his peers satisfy their insatiable appetites for quality frac sands in Brigham’s familiar old stomping grounds in West Texas. According to IHS Markit, Delaware and Midland basin operators put away 50 billion pounds of proppant in 2017, quadrupling 2014’s total. By 2022, forecasts call for annual Permian proppant consumption to quadruple again to 120 billion pounds–enough sand to fill 2.5 million hopper trailers to the brim

All About Contact

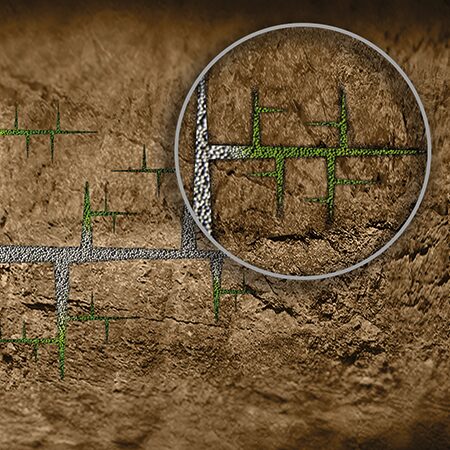

The end game for operators in horizontal resource plays is simple: Maximize the stimulated reservoir volume and keep induced fractures propped open so hydrocarbons keep flowing. Accomplishing those objectives, says Don Conkle, vice president of marketing and sales at CARBO, is leading the industry to pump more proppant per well.

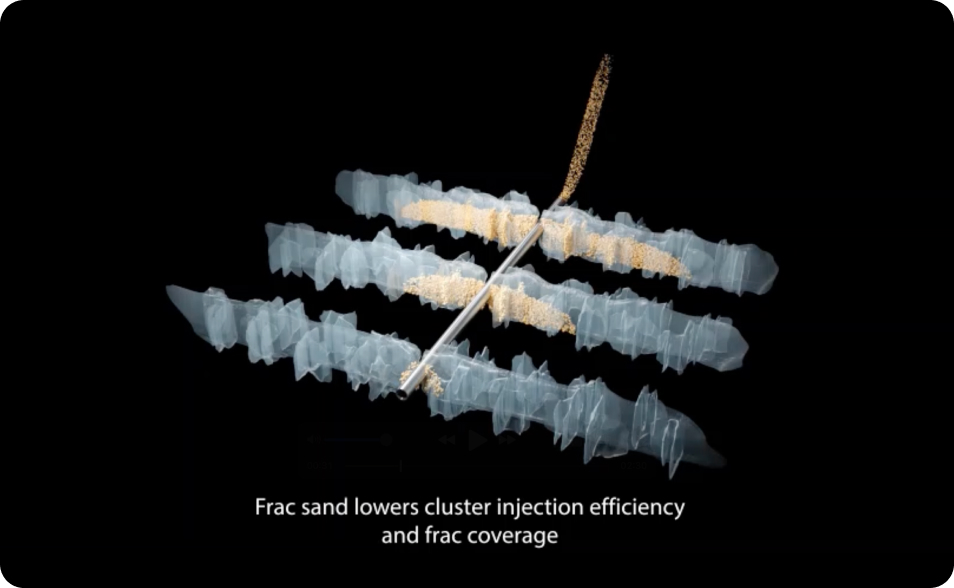

“There is an inclination to pump more proppant with closer fracture stages, increasing the number of clusters and reducing stage spacing,” he notes. “Some operators are using new diverter materials, biodegradable balls and other techniques to achieve a higher assurance of frac initiation, but the bottom line is a lot more proppant demand.”

According to Conkle, CARBO sold nearly 400 million pounds of premium ceramics/technology proppants and 2.2 billion pounds of natural and resin-coated sand products in 2017. He says demand for northern white sand is expected to remain strong in shale plays, particularly for 40/70- and 100-mesh.

While advancements have been made in reducing logistical costs and increasing supply flexibility, Conkle says most operators recognize that there is still more efficiency and productivity to be gained to maximize operator and shareholder returns. “I ask operators what inning they think they are in and they agree that the game is far from decided,” he relates.

Continuing the baseball analogy, Conkle says diagnostics and analytics technologies will be the next game changers to help operators better understand where proppant is going and how effectively reservoirs are being fractured to enhance productivity and efficiency. “For a hitter, how he contacts the ball can be the difference between a foul ball and a home run,” he says. “The same is true for reservoirs. It is all about contact and the permeability of the proppant pack.

“We know the closer the perforations and stages, the more contact there is between the lateral and the reservoir, and the better the production should be in the short term,” notes Conkle. “However, we do not know what effect that has over the long term, but are now learning.”

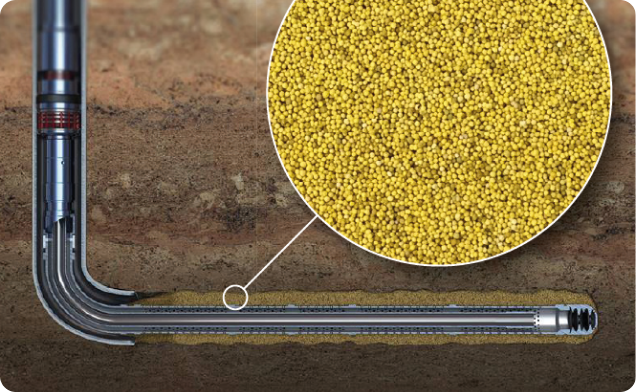

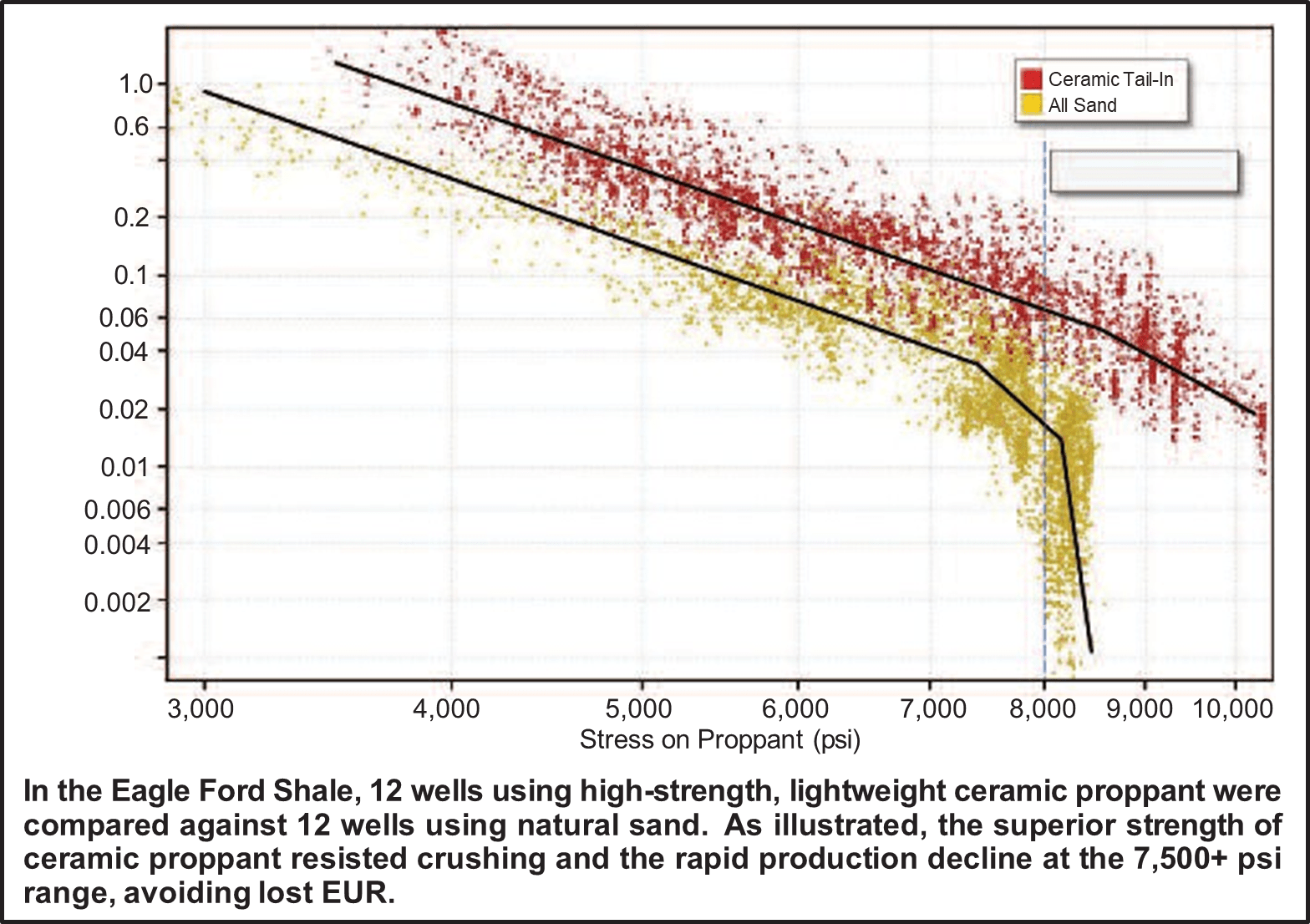

Shale wells characteristically decline rapidly, and as production falls off and flowing pressure declines, the frac begins closing on the proppant with increasing pressure. A study in the Eagle Ford compared productivity curves in 24 wells, in vertical wells. Conkle says the tracer is distributed throughout each proppant grain, allowing for the most accurate method to identify proppant location.

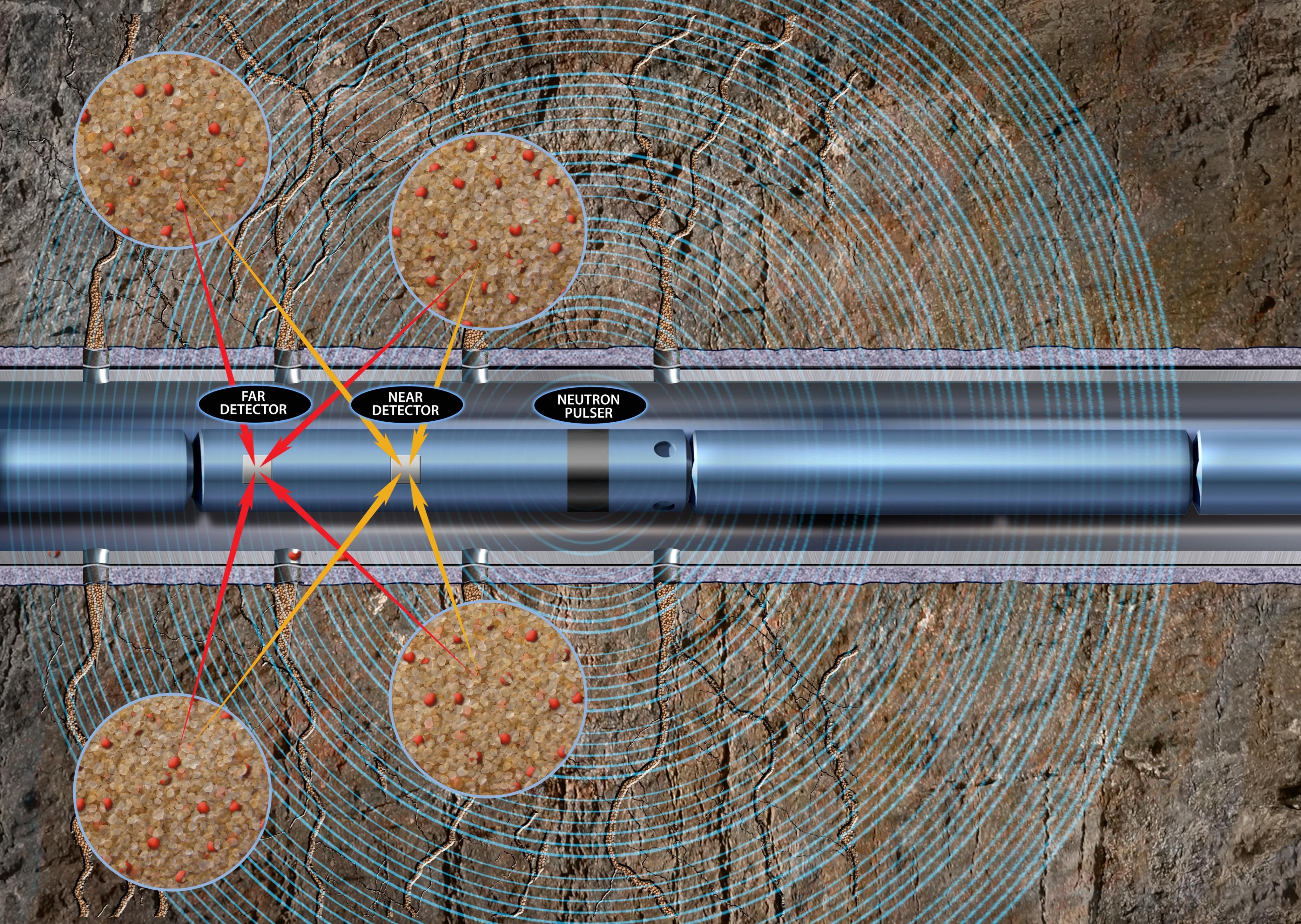

By year’s end, Conkle announces, CARBO plans to launch a new type of diagnostic service that uses a proprietary detectable proppant and electromagnetic detection technique to shed new light on proppant location within the reservoir-half of them propped with sand and the other with sand and higher-strength ceramics tailed in, Conkle details.

“As stress on proppant reached approximately 7,500 psi, the purpose and advantage of ceramic proppant became clear. A significantly steeper decline occurred in the productivity index of the dry gas wells propped with sand after 180 days of production than the ceramic tail-in wells,” he reports. “This is known as the ‘PI rollover,’ which could result in a decrease in forecasted reserves.”

In Utica dry gas wells, companies are starting to blend sand and CARBO’s KRYPTOSPHERE® ceramic, starting with 100-mesh sand and progressing to 40/70-mesh ceramic, 30/50-mesh ceramic, and finally tailing in 35-mesh KRYPTOSPHERE. “CNX Resources Corp. and several other operators have reported completing several wells in this manner with very strong results,” Conkle remarks.

New Solutions

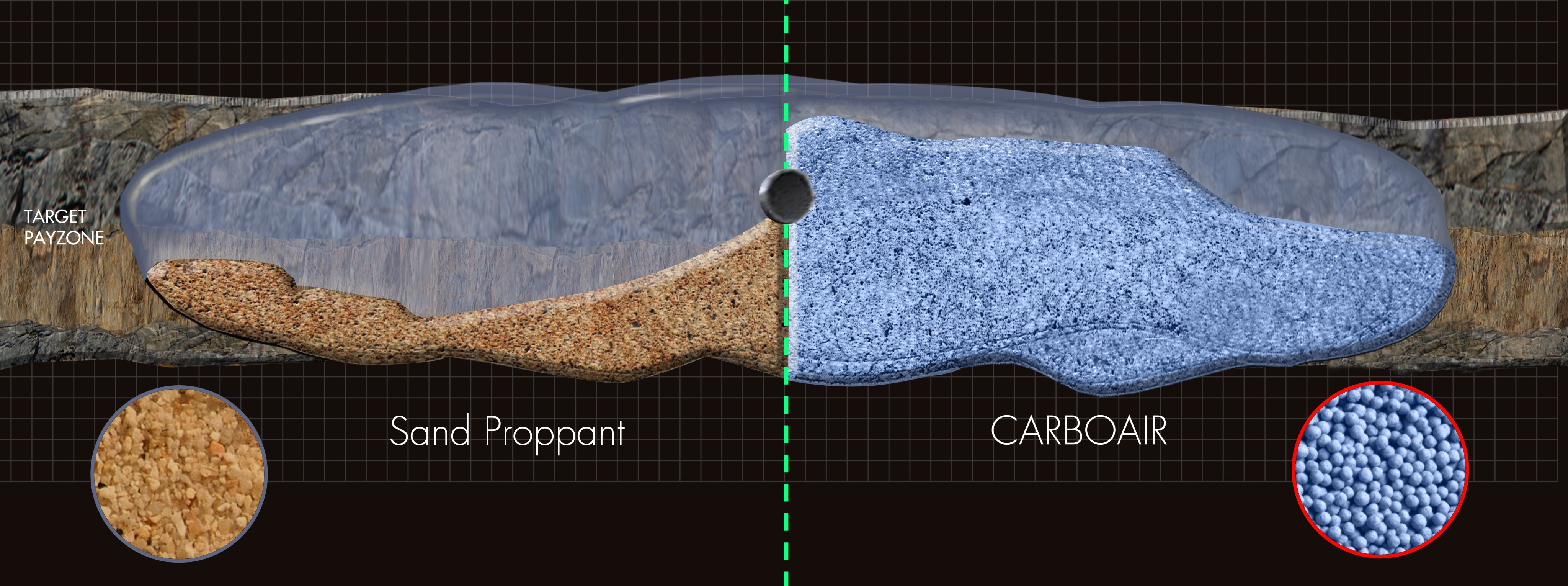

Conkle points to a well-documented challenge in proppant placement, noting that analysis shows sand often ends up falling out of the fluid stream a short distance into the created fracture. “Beyond that point, the fracture is left unpropped and eventually closes. Layering sand and an ultralow-density ceramic proppant such as CARBOAIR® is an effective way to address this ‘duning’ problem and obtain longer/higher propped fractures, especially farther from the wellbore.

“CARBOAIR is 28 percent lighter than sand, has a 12 percent higher pack-including in the far-field area away from the wellbore.

“Field trials demonstrate that the technology can detect the entire dimension of the frac,” Conkle enthuses. “The proppant is coated with a metallic substance, and an electromagnetic signal from the surface induces a response that shows the proppant’s geolocation. This represents a major step in giving operators 30 percent less water to place,” he continues, “resulting in 40 percent more volume being filled when pumping the same amount of mass.”

Pumping a mixture of sand and ceramic proppant can measurably improve reservoir contact, Conkle comments, referencing an operator in the Eagle Ford that performed a side-by-side comparison in virgin rock. “The only difference between the completions was that one well included a CARBOAIR tail-in,” he explains. “After six months, there was a 20 percent increase in production. Additional fine-tuning with hybrid designs could yield even more improvement.”

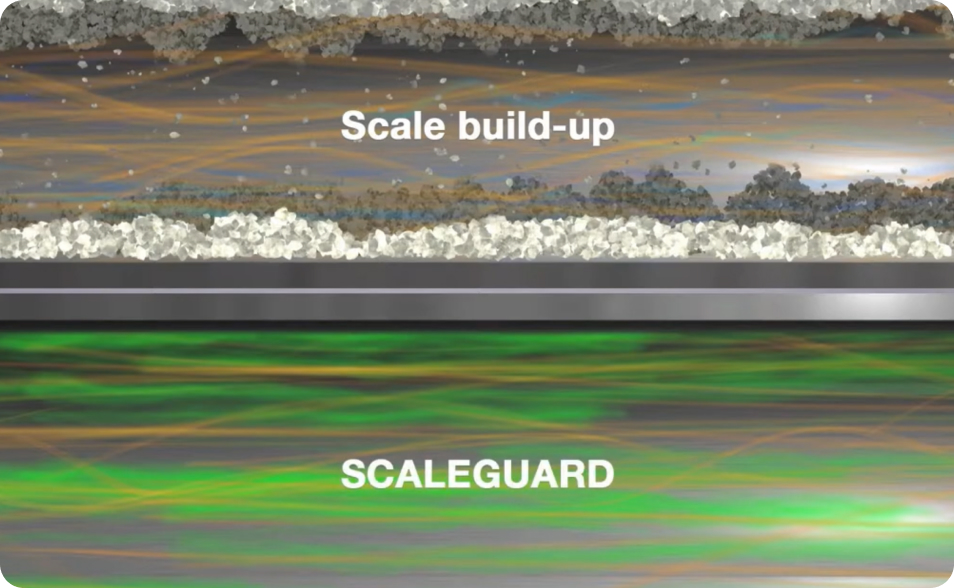

Among the newest solutions in CARBO’s product line is an engineered proppant that protects against scale and salt, and an ultrafine 200-mesh proppant the company has dubbed NANOMITE™. The engineered proppants are filled with inhibitors and coated with a semipermeable surface. “SCALEGUARD® is mixed with sand and/or base ceramic and pumped into fracs, where it treats the water that flows through it to mitigate scaling issues during production. It is particularly suited to the Permian, where scale can be a problem,” Conkle says. “NANOMITE can achieve better diversion and prop open small natural fractures in complex fracture networks.”

For diagnostics, CARBONRT® non-radioactive tracer helps operators pinpoint where proppant is located, assessing proppant entry points along a lateral in a horizontal well and propped fracture height insights they can use to optimize field development and completion designs. They will know how much of the reservoir they contact, how far fractures extend, and whether to change well spacing or zone perforation targets. It potentially could be key in evaluating their proppant and fluid selections”.